It has many ethnic groups, such as, Arabs, Turks, Persians, Jews, Kurds, Assyrian/Chaldean/Syriacs, Armenians, Azeris, Circassians, Greeks and Georgians. It is predominately Muslim, but Christian in Lebanon and Jewish in Israel. About its economy we can say that the Middle Eastern´s economies range from being very poor (such as Gaza and Yemen) to extremely wealthy nations (such as Qatar, UAE and Saudi Arabia).

We will focus, mainly, on Israel.

___________

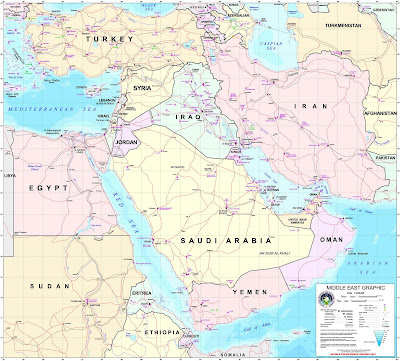

http://mediayork.org/pedia/commons/5/54/Middle_east_graphic_2003.jpg

ISRAEL

Israel is the world´s only predominantly Jewish state with a population of about 7.5 million people, of whom approximately 5.7 million are Jewish. The modern state of Israel has its historical and religious roots in the Biblical Land of Israel, also known as Zion.

In November 1947, the UN voted in favour of the partition of Palestine, proposing the creation of a Jewish state. Partition was accepted by Zionist leaders but rejected by Arab leaders. Israel declared independence on May 14th 1948 and neighbouring Arab states attacked the very next day.

Israel is a developed country and a representative democracy with a parliamentary system and universal suffrage. Israel is considered one of the most advanced countries in Southwest Asia in economic and industrial development. Jerusalem is the country´s capital, although it is not recognized internationally as such, while Israel´s main financial centre is Tel Aviv.

___________

http://www.infoplease.com/ipa/A0107652.html

___________

http://www.newsrealblog.com/wp-content/uploads/2010/03/IsraelFlag.jpg

ORGANISATIONAL CULTURE

The Kibbutz:

Is a society based on mutual aid and social justice and a socioeconomic system in which people share work and property. The social organization of work is unique in Kibbutz society. It is based on democratic foundations, with equal say for all members on work planning and the division of labour within their agricultural or industrial branch.

The kibbutz is an original and unique Israeli creation, a multi - generation, rural settlement, characterized by its collective and community lifestyle, democratic, management, responsibility for the welfare of each adult member and child, and shared ownership of its means of production and consumption.

The mutual sharing of wealth, all working to a common purpose; also Group commitment in which everyone is a valuable piece in the organisations, could be the Quaint essential value of something shared by a group of people. Here, everybody must coexist in a peaceful and harmonious environment.

The Kibbutz have gone through a big deal of transformation, many Israeli kibbutzim have developed into partially privatized, profit-seeking, professionally managed entities that act in capital, product, and factor markets just like private firms. The image of the bronzed and brawny kibbutz field worker was once the trademark of a young Israel, but the iconic agricultural communes are becoming a thing of the past.

___________

http://www.israelity.com/wp-content/uploads/2008/02/kibbutz.jpg

E - Commerce from an Islamic perspective

Islam encourages E-Commerce as a new way or technology of doing business. However, Muslim businessmen must ensure that he strictly followed the Islamic principles of conducting business. The transactions should be conducted in the truthful manner, there should be clarity in communication, avoid interest (Riba´) and ensured all the pillars of Islamic contract are met.

___________

Zainul, Osman and Mazlan, 2004.

These are, in order,

- Offer and Acceptance: Clear and confirmed by both parties.

- Two Contracting Parties: Majority of age is required.

- Subject Matter: The object of the sale must be beneficial, lawful in Islam, valuable, under possession, in existence and deliverable.

- Mode of Expression: Could be through words or written but it should be clear for both parties.

QUESTION

The financial industry in the Middle East has been traditionally influenced by religion. Today, Islamic banking appears as a growing and successful industry, not only in the Middle East but also in some western countries.

1. Explain what Islamic Banking is and its background.

Islamic banking has been defined as banking in consonance with the ethos and value system of Islam and governed, in addition to the conventional good governance and risk management rules, by the principles laid down by Islamic Shariah.

2. What are the key principles of Islamic banking ?.

Interest free banking is a narrow concept denoting a number of banking instruments or operations, which avoid interest. Islamic banking, the more general term is expected not only to avoid interest-based transactions, prohibited in the Islamic Shariah, but also to avoid unethical practices and participate actively in achieving the goals and objectives of an Islamic economy.

Islamic Shariah prohibits “interest” but it does not prohibit all gains on capital. It is only the increase stipulated or sought over the principal of a loan or debt that is prohibited. Islamic principles simply require that performance of capital should also be considered while rewarding the capital. The prohibition of a risk free return and permission of trading, as enshrined in the Verse 2:275 of the Holy Quran, makes the financial activities in an Islamic set-up real asset-backed with ability to cause “value addition”.

3. Islamic law forbids institutions from charging interests on loans. How do they make profits when lending money ?.

Islamic banking system is based on risk-sharing, owning and handling of physical goods, involvement in the process of trading, leasing and construction contracts using various Islamic modes of finance. As such, Islamic banks deal with asset management for the purpose of income generation. They will have to prudently handle the unique risks involved in management of assets by adherence to best practices of corporate governance. Once the banks have stable stream of Halal income, depositors will also receive stable and Halal income.

The Islamic economic system is concerned with social justice to ensure that none of the parties is being exploited without inhibiting individual enterprise. Extended to the Islamic financial system, this means that the funds individuals and / or companies put at risk share the profits or losses resulting from the enterprise. This concept of sharing the delights or pain of the outcome of business is a progressive one. Islamic banking encourages better resources management, in particular as outright speculation is not permitted by Shariah in Islamic law.

4. Explain the concept of ethical investments under Islamic law. Who is to determine whether an activity is allowed or not ?.

The participants are keeping pace with sophisticated techniques and have developed products that not only are ethically motivated but also profitable.

At their core, most Islamic financial products are essentially the same as their conventional equivalents. The main difference is the absence of interest and often complicated procedures to ensure compliance with Shariah.

5. How does Islamic banking influence the economy in the Middle East ?.

Over the last three decades Islamic banking and finance has developed into a full-fledged system and discipline reportedly growing at the rate of 15 % per annum. Today, Islamic financial institutions, in one form or the other, are working in about 75 countries of the world. Besides individual financial institutions operating in many countries, efforts have been underway to implement Islamic banking on a country wide and comprehensive basis in a number of countries.

The instruments used by them, both on assets and liabilities sides, have developed significantly and therefore, they are also participating in the money and capital market transactions. In Malaysia, Bahrain and a few other countries of the Gulf, Islamic banks and financial institutions are working parallel with the conventional system.

6. Based on your research and knowledge about this topic, what is the future of Islamic Banking in terms of global expansion and growth ?.

I don´t think it will grow big enough to threat the regular way of doing banking, because Jewish interest way to make money in regular banking rule the world and will never be overtaken by the Arab foe.

___________

1.http://www.kantakji.com/fiqh/Files/Banks/b084.pdf

2.http://www.thestandard.com.hk/news_detail.asp?we_cat=16&art_id=78556&sid=22829228&con_type=1&d_str=20090223&fc=1

No comments:

Post a Comment